nd sales tax rate lookup

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. The current total local sales tax rate in Sarles ND is 5000The December 2020 total local sales tax rate was also 5000.

Math Monday Use Desmos To Explore State And Local Tax Rates Blog

Souris ND Sales Tax Rate.

. Local lodging local lodging and restaurant alcohol. North Dakota imposes a sales tax on retail sales. Use it to calculate sales tax for any address in the United States.

The Horace sales tax rate is. To calculate sales and use tax only. North Dakota State.

What is the sales tax rate in Horace North Dakota. Tax rates are provided by Avalara and updated monthly. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656.

373 rows North Dakota Sales Tax. The North Dakota State North Dakota sales tax is 500 the same as the North Dakota state sales tax. Use this search tool to look up sales tax rates for any location in Washington.

The minimum combined 2022 sales tax rate for Horace North Dakota is. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more. The real trick is figuring out what needs to be taxed and then calculating the correct tax rate which depending on how your business operates could mean learning the rules in any number of the.

This is the total of state county and city sales tax rates. Local Sales Tax Rate Lookup The Sales and Use Tax Rate Locator only includes state and local sales and use tax rates and boundaries for North Dakota. North Dakota sales tax is comprised of 2 parts.

Depending on local municipalities the total tax rate can be as high as 85. Counties and cities in North Dakota are allowed to charge an additional local sales tax on top of the North Dakota state sales tax. The current total local sales tax rate in Souris ND is 5000The December 2020 total local sales tax rate was also 5000.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. The North Dakota ND state sales tax rate is currently 5. With local taxes the total sales tax.

In North Dakota the Office of State Tax Commissioner administers laws regarding the licensing regulation and tax for alcohol manufacturers and wholesalers. The North Dakota sales tax rate is currently. Its perfect if you need to lookup the tax rate for a specific address or zip code.

The 4 is optional. The County sales tax rate is. Sarles ND Sales Tax Rate.

The North Dakota State Sales Tax is collected by the merchant on all qualifying sales made within North Dakota State. Decimal degrees between 450 and 49005 Longitude. We are happy to offer it free of use for anyone needing to find a tax rate by address or who needs a sales tax calculator zip code.

Average Sales Tax With Local. Take the price of a taxable product or service and multiply it by the sales tax rate. Wednesday January 19 2022 - 1100 am.

North Dakota assesses local tax at the city and county levels but does not assess local tax for special jurisdictional areas such as school districts or transportation authorities. While many other states allow counties and other localities to collect a local option sales tax North Dakota does not permit local sales taxes to be collected. Did South Dakota v.

Licensing requirements and permitted operations vary depending on the type of business. North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0959 on top of the state tax. It does not include special taxes such as.

The sales tax rates database is available for either a one-time fee or a discounted subscription that will provide you with monthly updates for all local tax jurisdictions in North Dakota. Our dataset includes all local sales tax jurisdictions in North Dakota at state county city and district levels. There are a total of 213 local tax jurisdictions across the state collecting an average local tax of 0959.

North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 45. 31 rows The state sales tax rate in North Dakota is 5000. With sales tax though its almost never that easy.

At a glance calculating sales tax seems simple. Combined with the state sales tax the highest sales tax rate in North Dakota is 85 in the city of Tioga. The tax data is broken down by zip code and additional locality information location.

To calculate sales and use tax only. Its a simple tax rate finder for all US address locations. Decimal degrees between -1250.

North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a. This means that depending on your location within North Dakota the total tax you pay can be significantly higher than the 5 state sales tax. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the third quarter of 2021 are up 121 compared to the same timeframe in 2020.

The sales tax is paid by the purchaser and collected by the seller. Look up 2021 sales tax rates for Des Lacs North Dakota and surrounding areas.

Vermont Sales Tax Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

How To File And Pay Sales Tax In North Dakota Taxvalet

About The North Dakota Office Of State Tax Commissioner

The Consumer S Guide To Sales Tax Taxjar Developers

Car Tax By State Usa Manual Car Sales Tax Calculator

The Consumer S Guide To Sales Tax Taxjar Developers

How To File And Pay Sales Tax In North Dakota Taxvalet

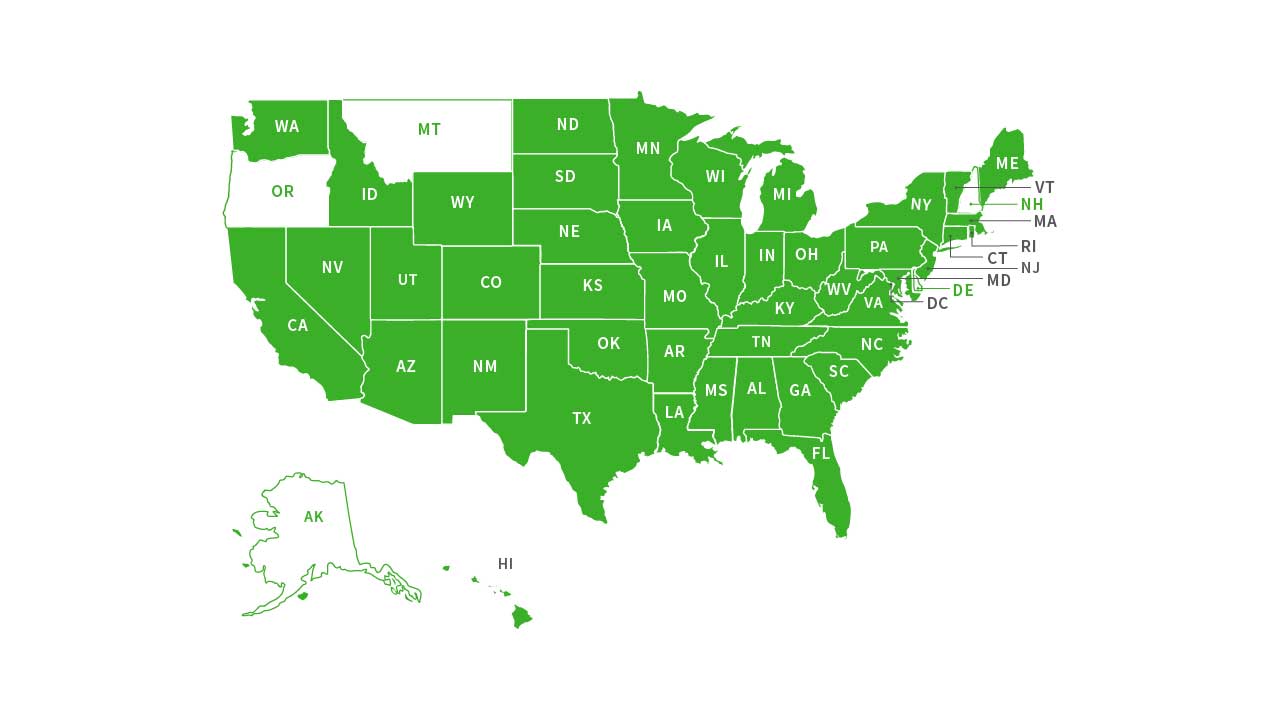

Avalara Salestax Free Sales Tax Calculator Rate Lookups Sales Tax Tax Map

Pisek North Dakota Sales Tax Calculator 2022 Investomatica

How To File And Pay Sales Tax In North Dakota Taxvalet

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Historical North Dakota Tax Policy Information Ballotpedia

North Dakota Sales Tax Handbook 2022

Pisek North Dakota Sales Tax Calculator 2022 Investomatica

The Consumer S Guide To Sales Tax Taxjar Developers